The first half of 2024 has seen significant activity in the African start-up ecosystem, despite a notable decrease in total transaction value compared to previous periods. As the global economic landscape continues to evolve, Africa’s start-up scene remains vibrant, presenting both challenges and opportunities for entrepreneurs and investors alike.

Total Transaction Value

In H1 2024, the total transaction value for start-ups across Africa reached $780 million, encompassing equity, debt, and grants (excluding exits). This represents a 31% decline from H2 2023 and a substantial 57% drop from H1 2023. The current economic climate and shifting investor priorities likely contribute to this decrease, but it also underscores the resilience and adaptability of the African start-up ecosystem.

Equity and Debt Breakdown

Equity funding accounted for 66% of the total transaction value, amounting to $513 million. This is a notable increase from 60% in 2023, indicating sustained investor confidence in the long-term potential of African start-ups. Debt financing, on the other hand, comprised 33% of the total at $254 million, down from 38% in 2023. This shift suggests a cautious approach by lenders amidst economic uncertainties.

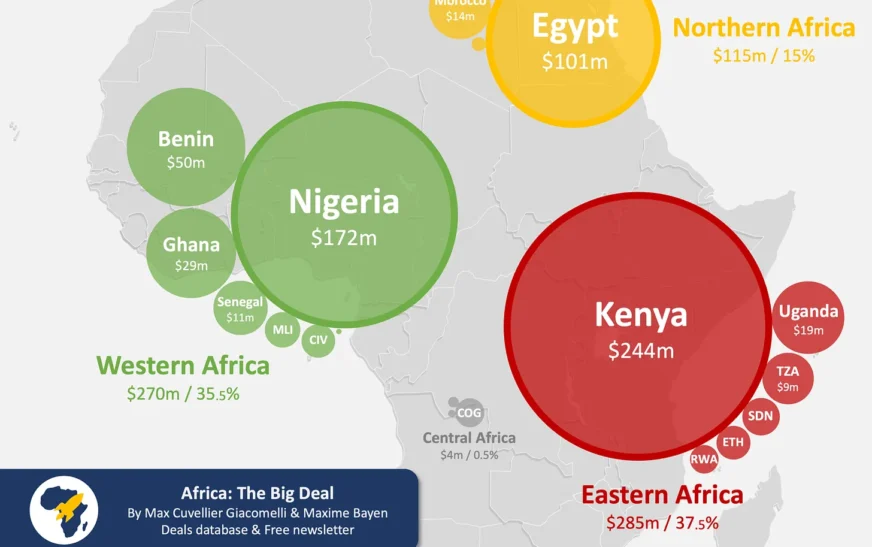

Geographic Distribution

The “Big Four” countries—Kenya, Nigeria, Egypt, and South Africa—continue to dominate the African start-up funding landscape, collectively attracting 79% of the total investment:

- Kenya: $244 million (32%)

- Nigeria: $172 million (23%)

- Egypt: $101 million (13%)

- South Africa: $85 million (11%)

Additionally, other countries also secured significant investments, including Benin ($50 million), Ghana ($29 million), Uganda ($19 million), Morocco ($14 million), and Senegal ($11 million).

Top Funded Start-ups

Several start-ups have emerged as major recipients of funding in H1 2024:

- Moove (Nigeria): Raised $100 million in equity from investors like Uber and Mubadala, plus $10 million in debt from Stride Ventures. Moove, operating in the transport and logistics sector, now boasts a valuation of $750 million.

- M-KOPA (Kenya): Secured a $51 million loan from the U.S. International Development Finance Corporation (DFC) to expand its energy solutions.

- Spiro (Benin): Obtained a $50 million debt facility from Afreximbank, further cementing its position in the transport and logistics sector.

Sector Analysis

The top sectors by total amount raised highlight key areas of growth and innovation:

- Transport & Logistics: $218 million (28%)

- Fintech: $186 million (24%)

- Energy & Water: $132 million (17%)

These sectors are critical for driving economic development and addressing fundamental needs across the continent.

Gender Dynamics in Funding

Despite progress in many areas, gender disparity in start-up funding persists. In H1 2024, 98% of the funding went to start-ups with at least one male founder, while only 15% was invested in those with at least one female founder. Even more striking, a mere 8% of the funding was allocated to start-ups with a female CEO. This highlights the need for targeted efforts to promote gender diversity and inclusion within the entrepreneurial ecosystem.

Looking Ahead

As we move into the second half of 2024, the African start-up ecosystem continues to evolve, driven by innovative solutions and resilient entrepreneurs. While challenges remain, particularly in terms of funding accessibility and gender equity, the opportunities for growth and impact are immense. By fostering a supportive environment for all entrepreneurs and leveraging the continent’s unique strengths, Africa can continue to build a thriving start-up landscape that benefits its economy and people.

For more detailed insights and analysis, join us for the Africa Start-Up Funding Round-Up event on July 23, 2024, where we will unpack all the funding trends for the first half of the year.

Source: The BigDeal