Snap Inc.’s second-quarter revenue fell slightly short of estimates, but the company saw a boost in paying subscribers and user growth. Learn more about their performance.

Snap Inc., the parent company of Snapchat, reported its second-quarter earnings, revealing a slight shortfall in revenue compared to analyst expectations. The company generated $1.24 billion in revenue for the quarter, just below the $1.25 billion forecasted by analysts. Despite this minor setback, Snap exceeded user growth expectations and maintained a revenue forecast for the current quarter that aligns with analyst predictions.

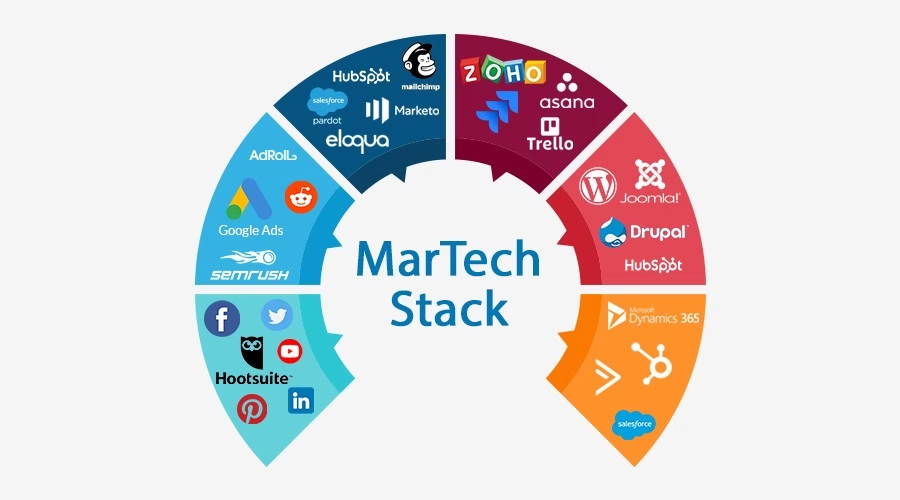

In recent years, Snap has been revamping its advertising approach, shifting from brand awareness campaigns to direct response ads aimed at encouraging specific user actions, such as app downloads or product purchases. This transition, while aimed at long-term profitability, led to several quarters of revenue decline before a recent rebound in growth.

During the second quarter, Snap attributed the revenue shortfall to a “weaker brand advertising environment” in certain categories. However, the company found some relief through its subscription product, Snapchat+, which now boasts 11 million paying subscribers. This service, priced at $3.99 per month and featuring an AI-powered chatbot, has become a critical component of Snap’s strategy to diversify beyond traditional advertising. Last quarter, Snapchat+ had 9 million subscribers.

Snapchat’s user base also saw significant growth, averaging 432 million daily active users in the second quarter, marking a 9% increase from the previous year and surpassing expectations. Looking ahead, Snap projects revenue between $1.34 billion and $1.38 billion for the current quarter, with the upper end of this range exceeding analyst estimates.

Despite these positives, Snap continues to face challenges in achieving profitability. The company has recently begun forecasting increased expenses in areas such as infrastructure, particularly for supporting its machine learning and AI technologies. Snap anticipates spending between 83 cents and 85 cents per user per quarter on these expenses this year. Bloomberg has estimated these costs could total about $1.5 billion for the year, representing over half of Snap’s annual operating expenses.

In the second quarter, Snap reported a net loss of $248.6 million, an improvement from the $377.3 million loss reported a year earlier. The company, along with other digital advertising giants like Meta Platforms Inc. and Alphabet Inc.’s Google, is heavily investing in AI technologies to enhance ad targeting, content recommendations, and the development of new products and services.

Snap is also integrating AI into its Spotlight video feed, which competes with TikTok. The company reported that its 850 million monthly users are spending 25% more time on Snapchat compared to a year ago, driven by improvements in Spotlight and Creator Stories.

To stay informed about the latest news and technology trends, visit 365marktech.africa for more updates.

Stay updated with the latest news and technology trends at 365marktech.africa. Click here to read more and keep informed on key developments!