The recent decision by Mercury Bank to close accounts of Nigerian startups could impact foreign investor confidence and disrupt the country’s startup ecosystem. Learn more about the potential effects and solutions.

Austin Okpagu, the Country Manager at Verto FX, has voiced significant concerns over the impact of Mercury Bank’s recent move to close accounts for Nigerian startups. This decision, which affects numerous startups dependent on Mercury for international transactions, threatens to undermine foreign investors’ trust in Nigeria’s startup ecosystem.

In a detailed interview with Nairametrics, Okpagu highlighted that the closure of these accounts will not only disrupt international payment processes but will also have a ripple effect on the daily operations of the startups involved. He cautioned that such disruptions could erode foreign investor confidence, potentially leading to decreased interest in Nigerian startups. This could create further barriers to global financial transactions, dissuade potential investors, and exacerbate the already sluggish growth of an ecosystem grappling with low capital inflows.

The account closures are also likely to impede innovation, as startups may struggle to scale their solutions internationally or even maintain their current operations. Okpagu described this development as a severe setback for Nigerian startups that were customers of Mercury, causing uncertainty and frustration among founders who may find few viable alternatives within Africa.

Additionally, this situation could negatively impact Nigeria’s reputation as a leading tech hub in Africa. Okpagu noted that prominent ecosystem enablers, like Microsoft, have recently scaled back their operations in Nigeria. This trend could have wider implications for the region and highlights the need for stakeholders to reconsider their dependence on foreign institutions. Investing in local financial institutions might offer a way to overcome these challenges.

Addressing the broader context, Okpagu discussed the ongoing issues with cross-border payments in Africa. He pointed out that the recurring issue of account closures by global banks underscores the need for Africa to bolster its financial infrastructure. While there has been progress, such as the development of the Pan-African Payment and Settlement System (PAPSS) and increased support from Nigeria’s Central Bank for International Money Transfers Operators (IMTOs), significant hurdles remain.

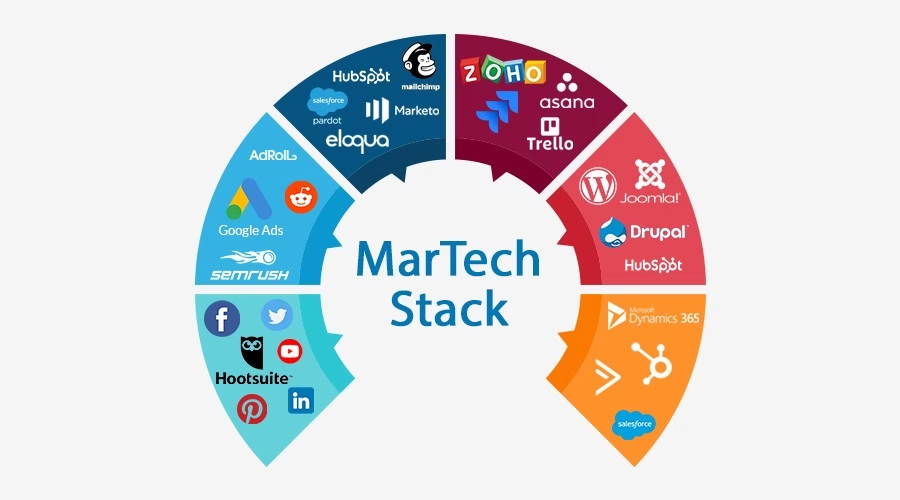

Verto FX, a global B2B financial technology company, is actively working to address inefficiencies in cross-border payments, including challenges related to liquidity, interoperability, and high transaction costs. Their goal is to enhance the financial landscape and provide better solutions for businesses involved in international trade.

For context, Mercury Bank, a U.S. institution serving startups globally, has announced plans to close accounts for Nigerian startups by August 22, 2024. This decision comes as Nigeria is listed among 37 prohibited countries, primarily affecting those in Africa and the Middle East.

Stay updated with the latest news in technology and finance by visiting 365marktech.africa for more insights and updates.

Image Source: Austin Okpagu